Sleeping In

At my house, waking up early has become somewhat of a rarity. That’s not something I thought I would ever say with three young children, but it has in fact happened (rejoice!). Dear parents of very young children, sleep depravity eventually ends, but you might think it never will! Both because of school being out and because of my wife working from home, the need to get up, get ready, and get out the door seems a distant memory. As is often the case, my son and I are usually up first, and I have recently been leaving for work without the girls being up at all. While I do miss seeing the girls in the morning, I don’t hate drinking my coffee in peace!

Even our French Bulldog Daisy has been slow to get up these days. What’s the point? She seems to have adjusted to this more sleep-friendly schedule and has been snoring away far into the morning.

If I am being honest, I wish our clients would have slept through March and April and not looked at any of their statements! Sometimes, not looking really is the best course of action to avoid any rash decision-making. It was very hard for all of us to watch the S&P go from up 5% for the year to down 31% in a matter of weeks. And, it was almost impossible to resist the urge to SELL, SELL, SELL.

We all get tired of the “stay the course” refrain, but if you are following a financial plan that assumes long-term goals, that is almost always the best approach. A recent article titled ‘Rip Van Winkle and the Stock Market’ from Scott Welch at Wisdom Tree did a good job of emphasizing this point:

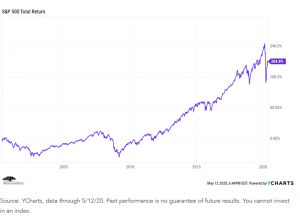

“So here is the game: I’m going to pick some dates from the past 20 years, and I’m going to put you to sleep for those periods of time, and then when you wake back up, I am going to show you the point-to-point total return performance of the S&P 500 Index…First up: From March 6, 2020 until May 12, 2020, a period of a little more than two months, covering a sizeable chunk of the current coronavirus disruption:”

The almost-recovery was almost as rapid as the decline. As of this writing, the S&P 500 is only down about 2.3% for the year. And, it briefly went positive for the year on June 8th. This is certainly not to say that we are out of the woods yet (from a market performance perspective), as many experts believe there will be another downturn before more consistent gains. However, if you are still an investor waiting to get back in, you have already missed a significant amount of recovery.

Lastly, if you are someone who is nearing or in retirement, keep in mind that does not mean you need to be in 100% safe assets. We often hear the refrain, “At my age, I can’t afford to take any risk at all.” Assuming you are healthy, it is not unreasonable to assume a 65-year-old retiree will still have a 20+ year time horizon for some of his/her investable assets. Yes, some money needs to be conservative for short-term income needs (2-3 year timeframe), however a large portion can still remain somewhat aggressive for better returns over the long term. How does 204.8% total return on your money sound over the last 20 years?

I hope you and family have a wonderful summer, and we all get to re-connect with those that we’ve been missing!

Nathan