Refi, Should I?

Happy 2021! Per Nathan’s last blog, I only have a couple of more weeks to say that, so I’m soaking it up. Cheers to everyone who has set their goals or resolutions for this year whether they be physical, mental, or financial in nature.

From a financial perspective, it is exciting to begin planning with our clients for a new year and building new goals together. So maybe it’s because I have it on my radar but I have seen and heard the headlines everywhere – “Interest rates at historic lows” or “Mortgage rates sink to all-time lows” and maybe most recently, “Mortgage rates move slightly higher but remain near record lows”. These headlines instill the feeling of FOMO (Fear Of Missing Out) in many homeowners. If you are already a homeowner you may be asking yourself, is now a good time to refinance? And is refinancing the right decision in the first place?

Fixed-rate mortgage and refinance rates are affected by several large factors including:

- Strength of the economy

- Employment

- Inflation rates

- Consumer spending

- Housing market

- Federal Reserve policies

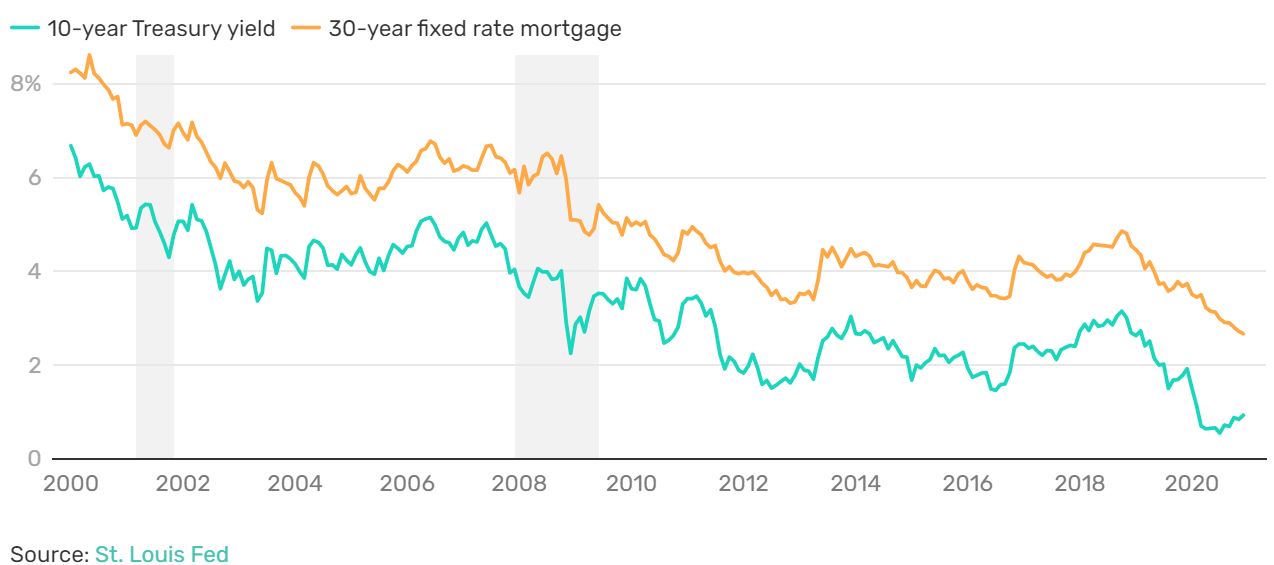

- 10 year Treasury Yields

The relationship between yield on 10-year Treasuries and most specifically 30 year fixed rate mortgages is outlined below. The yield of Treasury bonds is a function of expected economic conditions, supply and demand, inflation expectations, as well as monetary policy (the Federal Reserve).

Over approximately the last year and a half, the Federal Reserve cut the interest rates three times initially in response to the threat of recession following an economic boom and most recently in an effort to help the economy recover from the pandemic. While the rates the Federal Reserve controls are not the exact same thing as consumer interest rates, the increase or decrease of these rates trickles down to borrowers. In addition, the Federal Reserve’s purchase of Treasuries increases these bond prices, which in turn decreases the yield of the bonds.

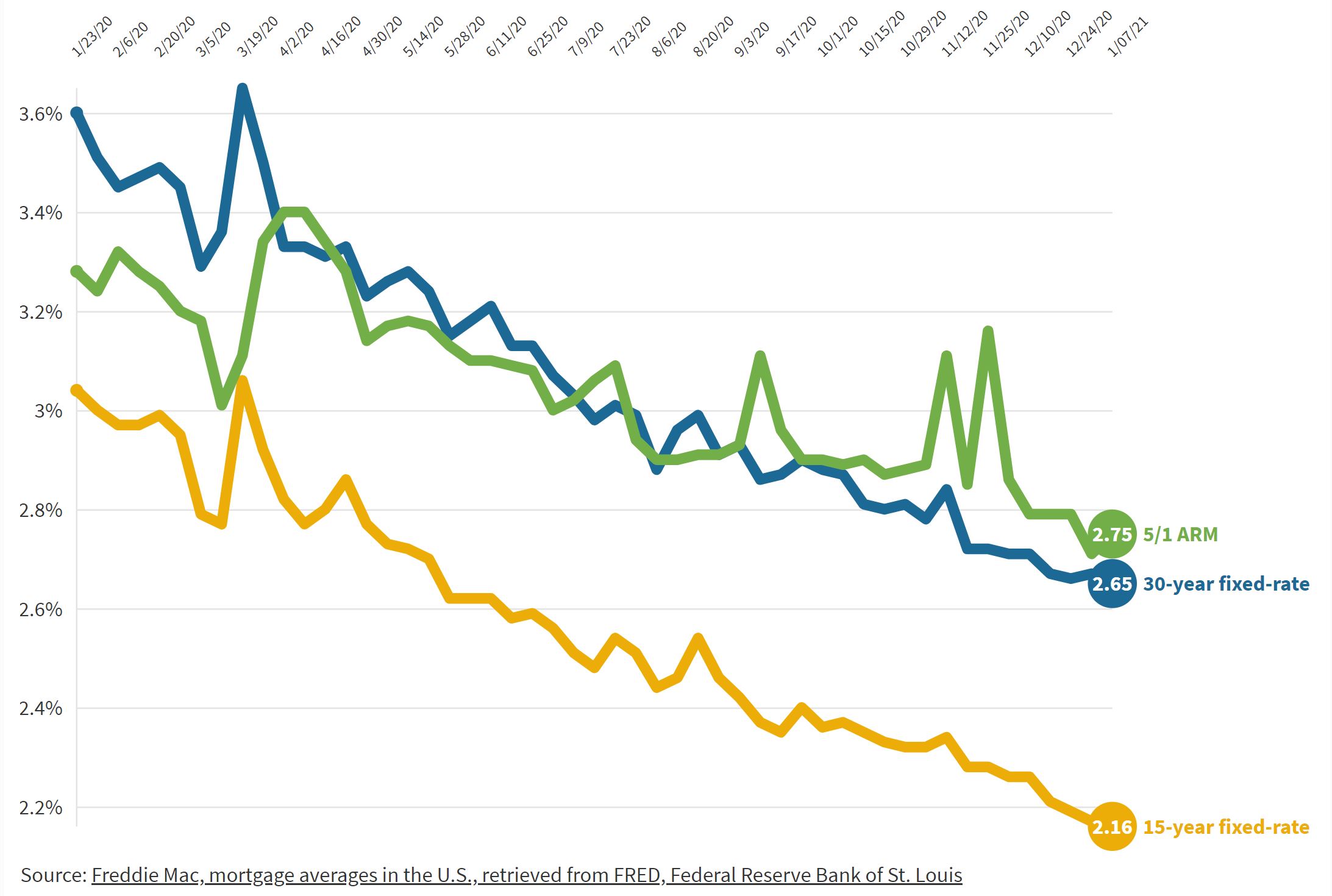

The combination of the economic condition and monetary policy have aided in pushing mortgage rates the lowest many homeowners have ever seen.

With interest rates as low as they are, and News Years goals of saving more and / or paying down debts, the question of whether to refinance now or not is sitting in many homeowner’s minds.

While the larger scale influences mentioned earlier do cause the fluctuation in the average mortgage rate, individual economic factors such as credit score / history, debt to income ratio, down payment size, loan type, and term all determine if a homeowner actually qualifies for the historic low rates.

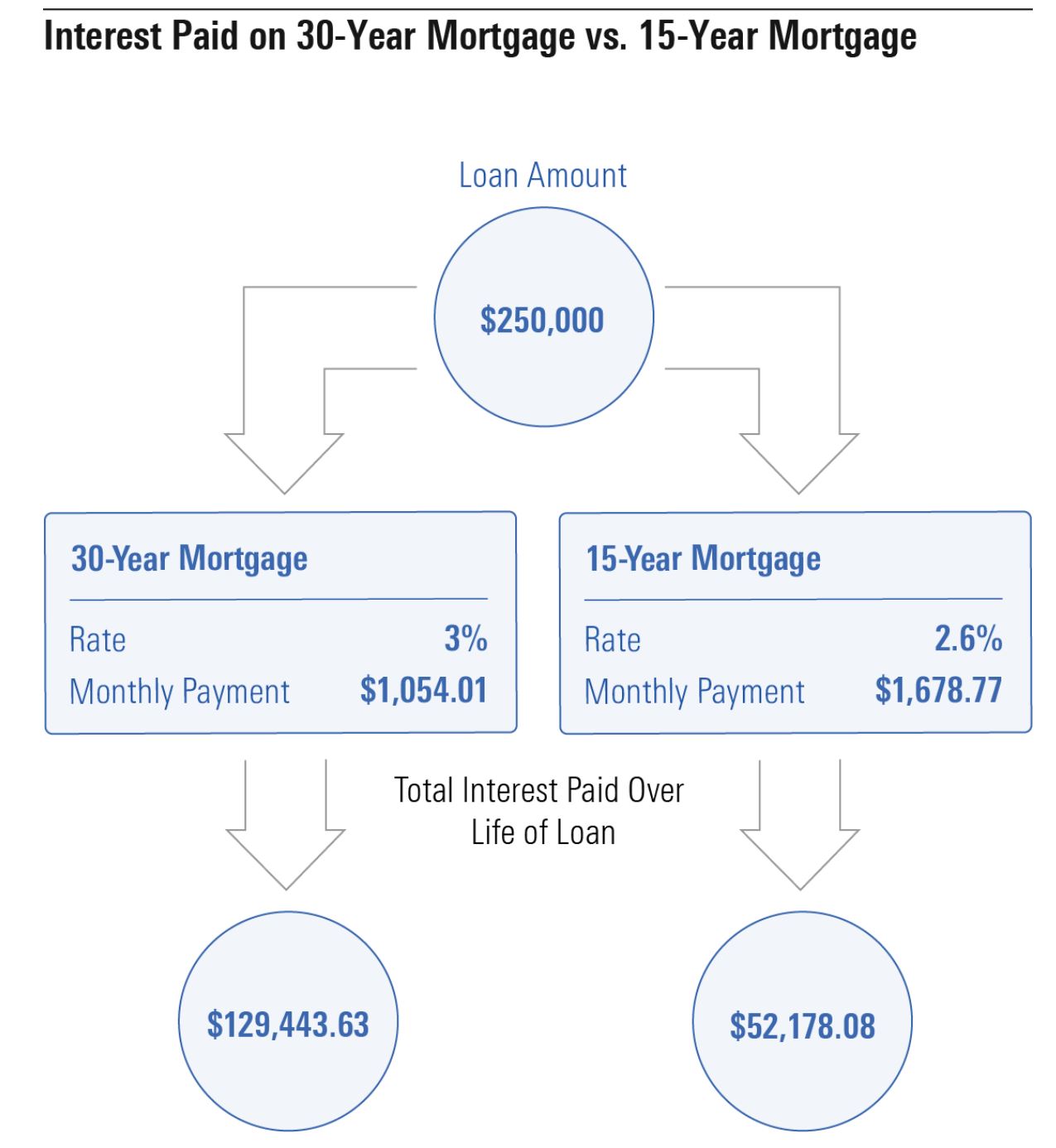

Keeping the individual economic factors into consideration, it is also critical to think about cashflow, timelines for staying in the home, and the goal for refinancing. Refinancing to a lower interest rate and a shorter term or at least the current term of your mortgage reduces overall interest paid; however, the monthly payment increases. Refinancing to a lower interest rate and a longer term mortgage reduces the monthly payment, but in most cases increases the overall interest paid. And that’s not adding on the costs of refinancing.

Another factor to consider is how long you plan on staying in the home, which will determine if you meet or exceed the break even point related to the cost of refinancing. Refinancing can cost an average of 2%-5% on top of the loan amount. For example, if closing costs were $8,000 and you saved $300 / month in your payment, it would take a little over 2 years to recoup those costs. But if you plan on staying in your home long-term, this isn’t an issue.

When it comes to figuring out how much of a drop in interest rates is worth refinancing, “rule of thumb” suggests that refinancing down 1% is enough of a drop that the savings outweighs the costs of refinancing. But just because one lender quotes you one rate does not mean that it is set in stone, shopping around for competitive rates is worthwhile. Also utilizing a mortgage refinance calculator like this one is very helpful when trying to crunch the numbers. https://www.bankrate.com/calculators/mortgages/refinance-calculator.aspx

Most recently one thing to keep in mind when looking at refinancing is the newly added refinance fee, otherwise known as the “adverse market refinance fee” of 0.5% added by the Federal Housing Finance Agency. However, if your principal balance is less than $125,000 or you are refinancing a VA or FHA loan, you are exempt from this. Another thing to note is that this fee is charged directly to lenders, not to borrowers, so it is up to your lender to determine how they want to pass this along to the consumer.

So with rated this low, will they continue to remain low and for how long? If I knew the exact answer, believe me I would tell you!! What we do know is there is a high possibility of additional stimulus in response to the ongoing pandemic as well as a projected economic recovery throughout 2021, which could in turn result in a steeper yield curve and therefore mortgage interest rates might increase, but the consensus is the increase would be minimal for the time being.

Refinancing can be an excellent way to accomplish financial goals and achieve those New Year financial resolutions as long as the costs and long-term effects on the overall financial plan are weighed against the potential cost savings. It’s definitely easy to be encouraged by the headlines “LOW LOW LOW”, but looking at the bigger picture and individual financial goals will help answer the question ,“Should I refi?”