4% Rule

After eight years of writing blogs, all of us at Meridian are always thankful when a reader suggests a topic that they would like to know more about…and I lucked out with a suggestion for this week that is both nerdy and timely…my favorite kinds of things to write about! The question was…is the 4% withdrawal rule still relevant in today’s market environment?

As Sarah Irving wrote about in her blog post earlier this year, one main rule of thumb in retirement planning is that you can generally withdraw about 4% of your retirement portfolio annually during retirement (and adjust that initial 4% amount annually for retirement. So, if your retirement portfolio is $1,000,000 when you retire, the “safe” withdrawal rate of 4% allows you to withdraw $40,000 during your first year of retirement. The following year, you would be able to take $40,000 multiplied by the past year’s inflation rate, and so on…

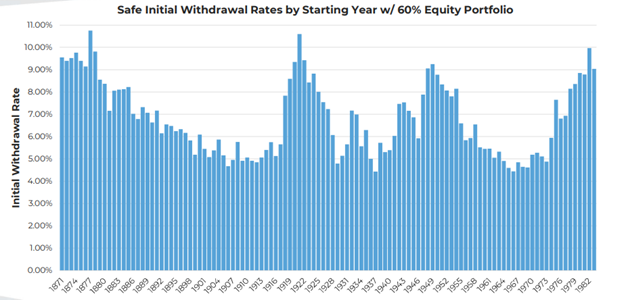

This 4% rule was pioneered by research by Bill Bengen in 1994—Mr. Bengen basically looked at 30 year rolling returns, starting in every year since 1871, and figured out what the safe initial withdrawal amount would have been…the range of “safe” withdrawal rates ranged from 4.5% to 11% across the rolling periods…

Source: https://www.kitces.com/blog/what-returns-are-safe-withdrawal-rates-really-based-upon/

Essentially, the 4% rule was born from what would have been the safe rate under the worst market conditions over a 30 year time frame. When the research was published, the paper was instantly criticized for being too conservative…and in fact, when JP Morgan studied the 4% rule, they found that a starting portfolio of $1,000,000 ended at that value or much higher in 65% of the 30 year periods studied.

https://am.jpmorgan.com/us/en/asset-management/adv/insights/retirement-insights/guide-to-retirement/

In the recent decade, the criticism was swung the other way—with bonds yielding 1% and stock returns projected in the low single digits, a balanced portfolio was estimated to grow at a much slower pace than in past historical periods. And in January 2022, Morningstar Research published a paper that suggested that in the environment of low rates and high stock valuations, 3.3% was the maximum safe rate.

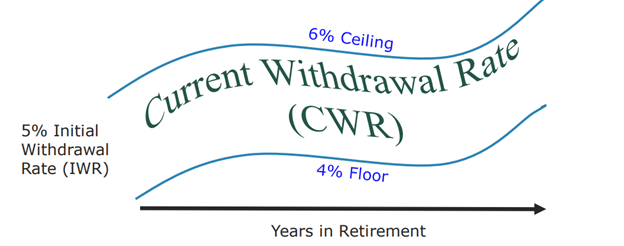

In dissecting and debunking that article (which Morningstar has since reversed and is now pedalling a 6% rule!), the research all agreed on one main point…the 4% rule was really intended to be a floor for spending, not a ceiling. Since a 4% withdrawal rate was based on the rate you would have been limited to in the absolute worst timing of retirement and sequencing of investment returns, in reality, the actual withdrawal amount could be higher. With bond interest rates now 5% and stock valuations far more reasonable, a balanced portfolio can possibly sustain higher withdrawal rates—Morningstar research says 6%, others say 5%, and Michael Kitces (a widely respected financial planner and analyst) recommends a banded approach that allows the rate to float between a safe floor to a safe ceiling:

Source: https://www.kitces.com/blog/probability-of-success-driven-guardrails-advantages-monte-carlo-simulations-analysis-communication/

Like Sarah Irving pointed out, the rule of thumb is great…but one size doesn’t fit all. And, in practicality, a safe withdrawal rate looks different for everyone. In practice, we have many retirees that withdraw far higher than 4% initially…because they are delaying social security benefits until age 70. So, we intentionally chose to withdraw higher than the rule of thumb as a tradeoff for not having to take large withdrawals when maximum social security benefits kick in.

Also, in practice, retirement expenses are not constant (even as adjusted for inflation). As David Blanchett found in his 2014 study, retirement expenses often look like a smile:

Source: https://retirementresearcher.com/retirement-spending-smile/

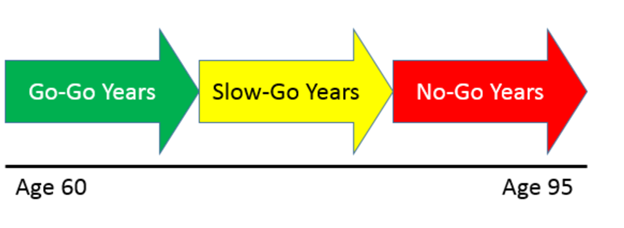

While the 4% rule assumes that the withdrawal amount is constant (only adjusted annually for inflation), the research shows that there tends to be three distinct phases to retirement:

https://www.kitces.com/blog/estimating-changes-in-retirement-expenditures-and-the-retirement-spending-smile/

The initial go-go phase of retirement has lots of activities, travel, new hobbies…which eventually slows to a more mundane pace (with lower costs). And, then health expenses begin to grow in the last phase of retirement. JP Morgan research shows a similar pattern, based on their banking and credit card data:

Source: https://am.jpmorgan.com/us/en/asset-management/adv/insights/retirement-insights/guide-to-retirement/

So, long post condensed…(TLDR):

Yes—the 4% rule is still relevant today…but just as when it was published, it is a guideline/floor to start the withdrawal conversation, not a rule carved in stone. When we make retirement plans, we use a 4% withdrawal rate as a checkpoint…like a pulse check at the doctor’s office. If we do have a plan with a higher than usual withdrawal rate, we examine the planned withdrawals closely to make sure they are in line for the unique set of circumstances of each client.

Speaking of other guidelines that aren’t exactly set in stone…Christmas trees and Christmas music must stay firmly after Thanksgiving Day in the Yakel house…agree or disagree?