Asset Classes

What is an asset class?

An asset class is a group of similar kinds of investments. It’s a generalization, not a detailed description, and can help you understand and manage your investments at a high level.

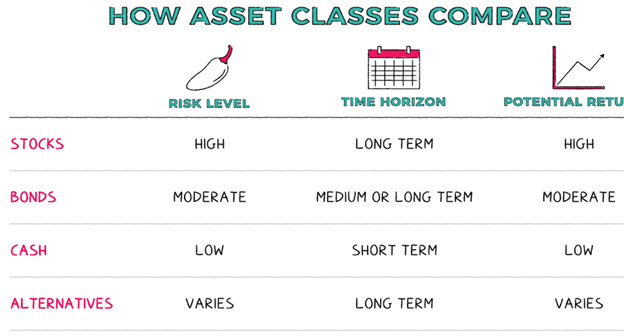

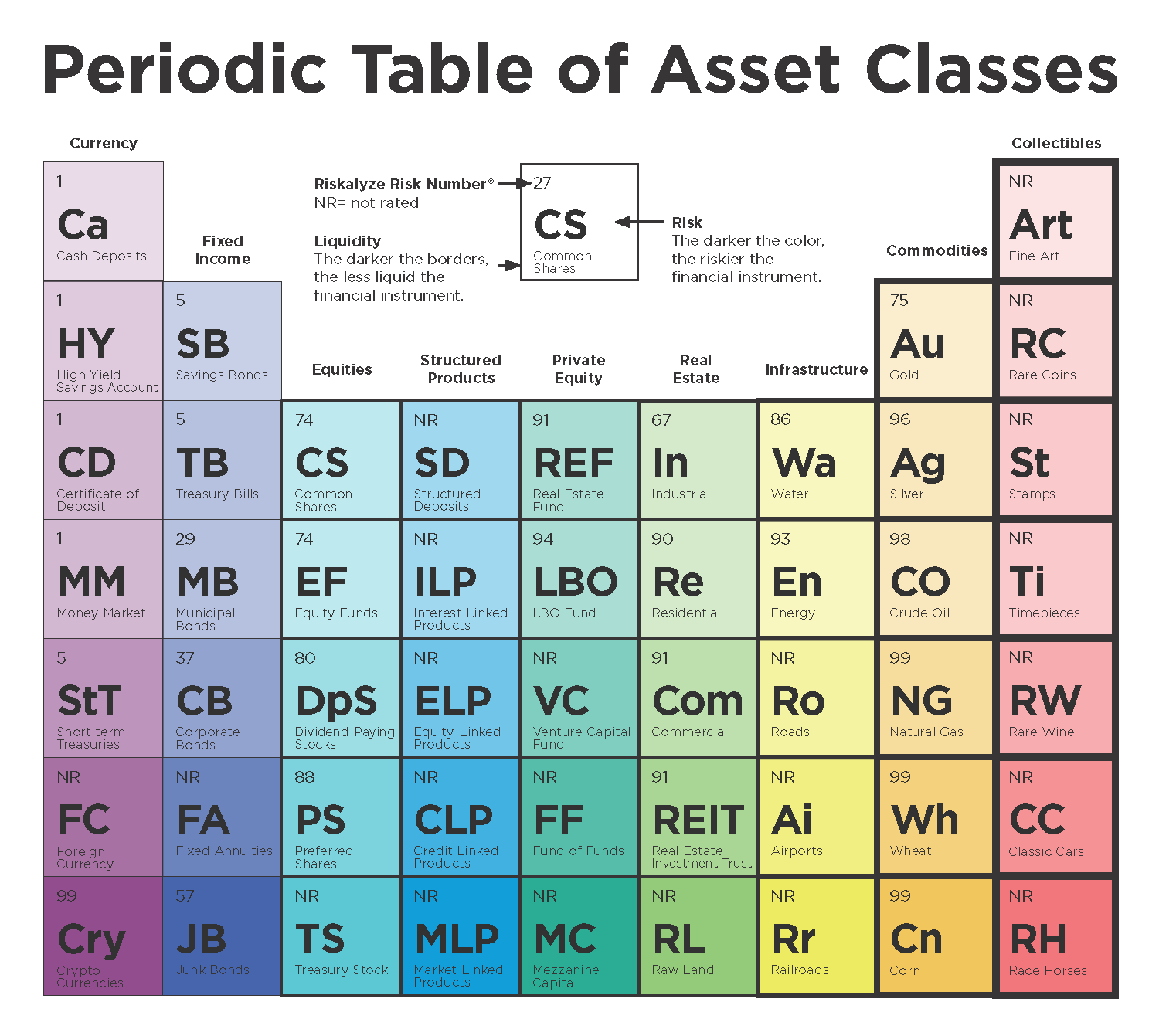

The four main asset classes are:

- Stocks––when you buy a stock, you become a part-owner of a company.

- Bonds––when you buy a bond, you become a lender.

- Cash and cash equivalents––this includes savings accounts, money markets, and Certificates of Deposit, not just the stuff in your wallet.

- Alternatives––this includes real estate, commodities, and other investments that don’t fall neatly into one of the other three buckets.

How to use

Asset classes are the building blocks you use to put together a portfolio. But which ones you use, and how you put them together, is important too.

- Time horizon: Some asset classes make good short-term investments, while others make more sense for investors with long time frames.

- Risk: All investments come with risk, but some asset classes are riskier than others.

By John Kador. Design by KathleenKowal.com

Why stocks?

Stocks are probably what you think of when you hear the word “investing.” When you buy shares of a company’s stock, you become a part-owner of that company. In buying shares, you’re essentially betting that the stock price will go up over time so that you can cash in.

Stocks can be high risk—the company could go under, or a PR snaffu could tank the value of your shares. There are no guarantees that your investment will pay off.

That said––although stocks can lose value in the short run, and individual stocks can even go completely bust––in the long run, stocks as a group tend to return more than other asset classes.

Why bonds?

Investing in bonds is generally considered less risky than investing in stocks.

There are several types of bonds, including:

- Corporate––issued by corporations

- Municipal––issued by state and local governments

- S. Treasuries––issued by the federal government

Bonds typically return more than cash but less than stocks. U.S. Treasuries are very safe, but some bonds––such as ones issued by a company on the brink of bankruptcy––can be almost as risky as stocks. Bonds are also impacted by other risks, such as inflation and changes in interest rates.

Most bonds pay interest twice a year, and when they mature you get the principal amount back.

Why cash?

Cash is the safest investment you can make (and it comes in handy in a financial bind). The FDIC insures your cash for up to $250,000 per person at covered banks, so cash can bring you peace of mind, too. The government generally protects cash equivalents, such as Certificates of Deposit, too. But CDs lock up your money for fixed terms, such as six months or five years, so they’re not the right choice if you might need to access your money sooner.

The biggest risk to think about with cash is inflation. If, for example, you kept $5,000 in a savings account with a 1% interest rate, but the inflation rate is 1.7%, your money will have less buying power later on.

So cash and its equivalents are great for emergencies, but they aren’t the most lucrative way to invest.

Why alternatives?

Alternative investments, such as real estate, commodities, and hedge funds, vary in risk—but some can be very risky, so they’re not right for everyone. (They also tend to come with higher fees than plain investments.) For those who are willing and able to take on the risk, alternatives can give investors an extra level of diversification.

Using asset classes to diversify

Investing in a few different asset classes is one of the most important ways of diversifying your investments and reducing your portfolio’s risk. So if you were to invest in stocks and open a savings account, that would be one kind of diversification.

You can also diversify within the same asset class. That would be like buying shares of Google and its competitor—you know the one.

Asset classes are categories of investments, such as stocks, bonds, cash, and alternatives. Thinking about your investments in terms of asset classes can give you a big-picture perspective on your portfolio and help you make sure your investments match your risk tolerance and time horizon. Make sure your risk tolerance is up to date by taking this quick questionnaire. Have questions? Reach out to your advisor today to chat about your risk number.