Basic Instincts

It’s tough to fight against an innate instinct. Nature is filled with examples of instincts at work—animals have extremely strong predator or prey behaviors, as anyone who has ever been dragged by their dog chasing a squirrel can attest…

…or attempted to shield the family guinea pigs (prey animals) from the family dog (the predator)…

Little boys have a basic instinct to wrestle and perform daring feats, both of which are often ill advised:

Ben and his recently broken finger

Now we are struggling with a little boy’s basic instinct to move and be active when he needs to be calm and let his broken finger heal…

Humans have a strong self preservation instinct—this desire to protect ourselves from harm leads to the fight or flight mentality. When we perceive danger, we instinctively move to confront and fight the threat or run away and avoid it. That strong sense of avoidance of danger helps us stay safe and is a wonderful tool, but it can cause poor decisions when it comes to investing.

We invest for long term goals, but when the stock market drops quickly, like it did last week, we feel as if we are in danger, and our basic instinct is to sell and exit the market immediately to be safe. The problem with acting on this instinct is that daily fluctuations in the market are extremely unreliable signals of actual danger. Daily volatility is normal for the market…and big drops are often followed by big reversals upward.

In this chart from a great blog post by Ben Carlson, you can see that the 25 best days of performance in the S&P 500 since 1970 were often clustered with the worst preforming days.

Source: https://awealthofcommonsense.com/2018/04/situational-awareness/

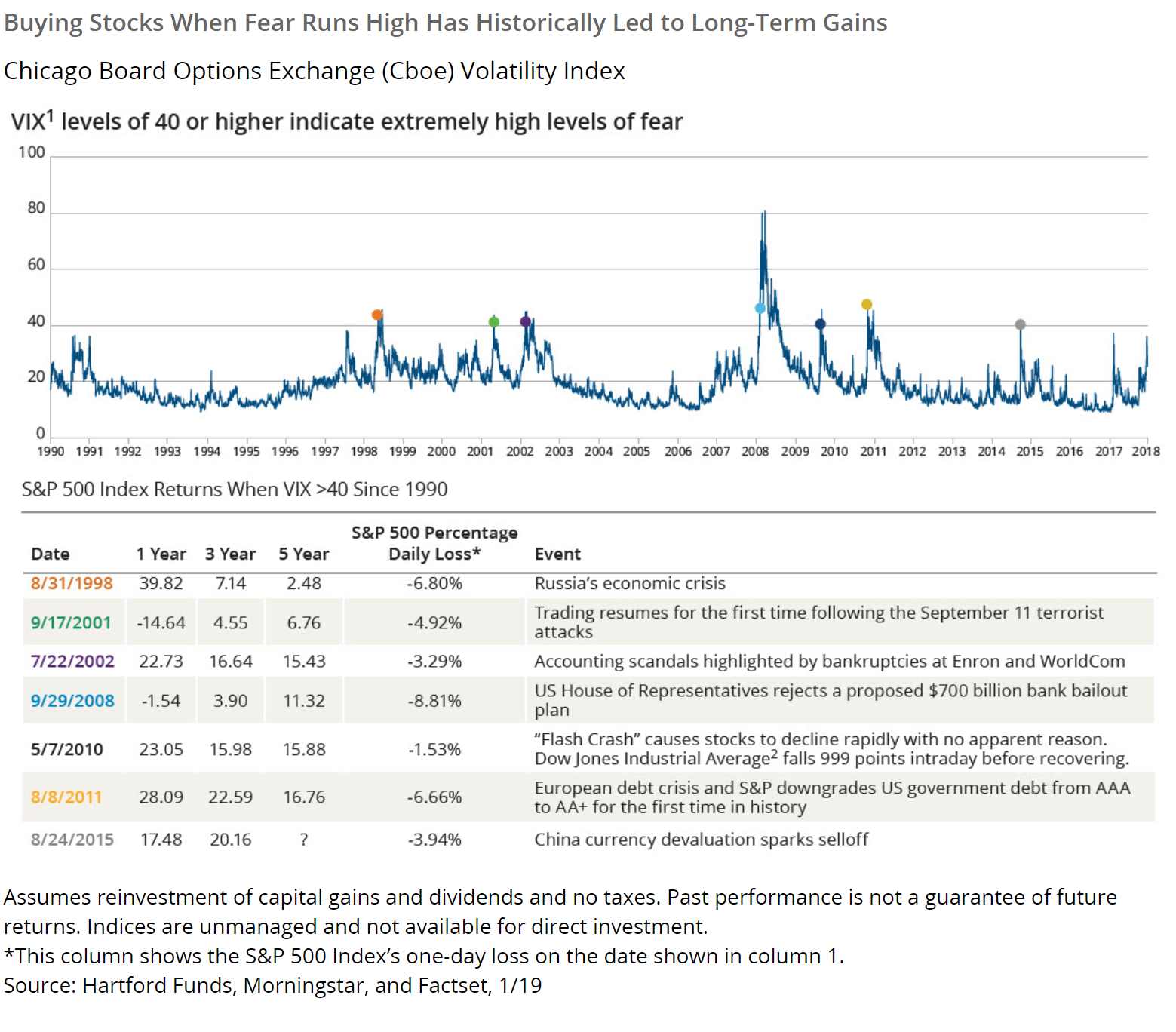

When fear in the market is high, and big daily drops occur, our desire to stay safe can cause panic. However, stepping back, when fear is high in the market (as measured by the VIX index), staying invested can actually be profitable in the long run. A recent study by Hartford found that when fear is running high in the market, as measured by VIX readings about 40, subsequent market returns were strongly positive:

In each of these instances, the immediate daily loss was painful, but holding on to equity positions instead of selling in a panic was rewarded over time.

As Nathan pointed out in his blog last week, staying invested over the entire market cycle has historically been rewarded. Just missing the 10 best market days in a 15 year period can reduce your total portfolio returns by 50%.

So, as hard as it is to fight a basic instinct to protect your portfolio by fleeing the market, we hope the rational argument helps you feel safe to stay invested.