Cash is Rarely King

As with many things, doing what “feels” good can seem like the best way forward. In our current market and rate environment, it feels pretty darn good to leave money in cash (savings, CDs, checking accounts, and money market checking). After all, the silver lining around all of the recent Fed rate increases is that banks are paying more interest. Throw in bad stock and bond market returns last year, and you’ve got a recipe for complacency. In fact, money market account balances have reached their highest point since May of 2020. ‘I will wait until things feel better to invest my cash’ is an oft repeated refrain.

Unfortunately, there are serious flaws in that logic. The whole reason that the Fed is raising rates in the first place is an attempt to bring down the prices of things we buy and use everyday (aka inflation). And, the headline inflation number (CPI or Consumer Price Index) remains at a stubbornly high 6.4%. Food prices alone have gone up over 10% since this same time last year.

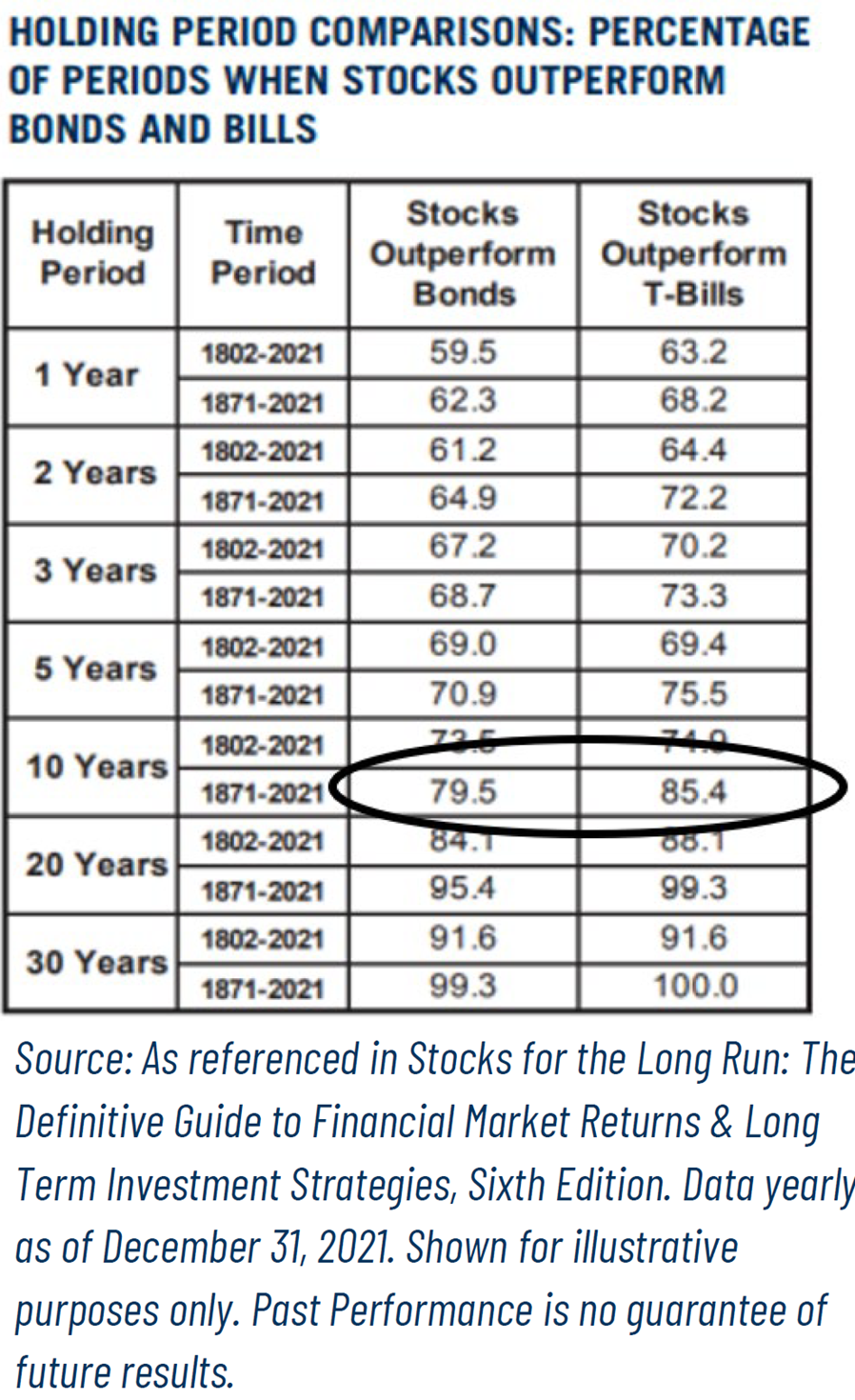

What many investors fail to take into account is purchasing power. With the exception of quickly accessible money in case of emergency, investors should consider a portfolio that gives them a chance to oupace the rate of inflation. So, if you are sitting in a bank CD paying 4% for 12 months, your money is actually losing about 2.4% of purchasing power (6.4% – 4% = 2.4%). A well-built portfolio of dividend-paying stocks and high quality bonds could provide a more sound alternative when searching for yield.

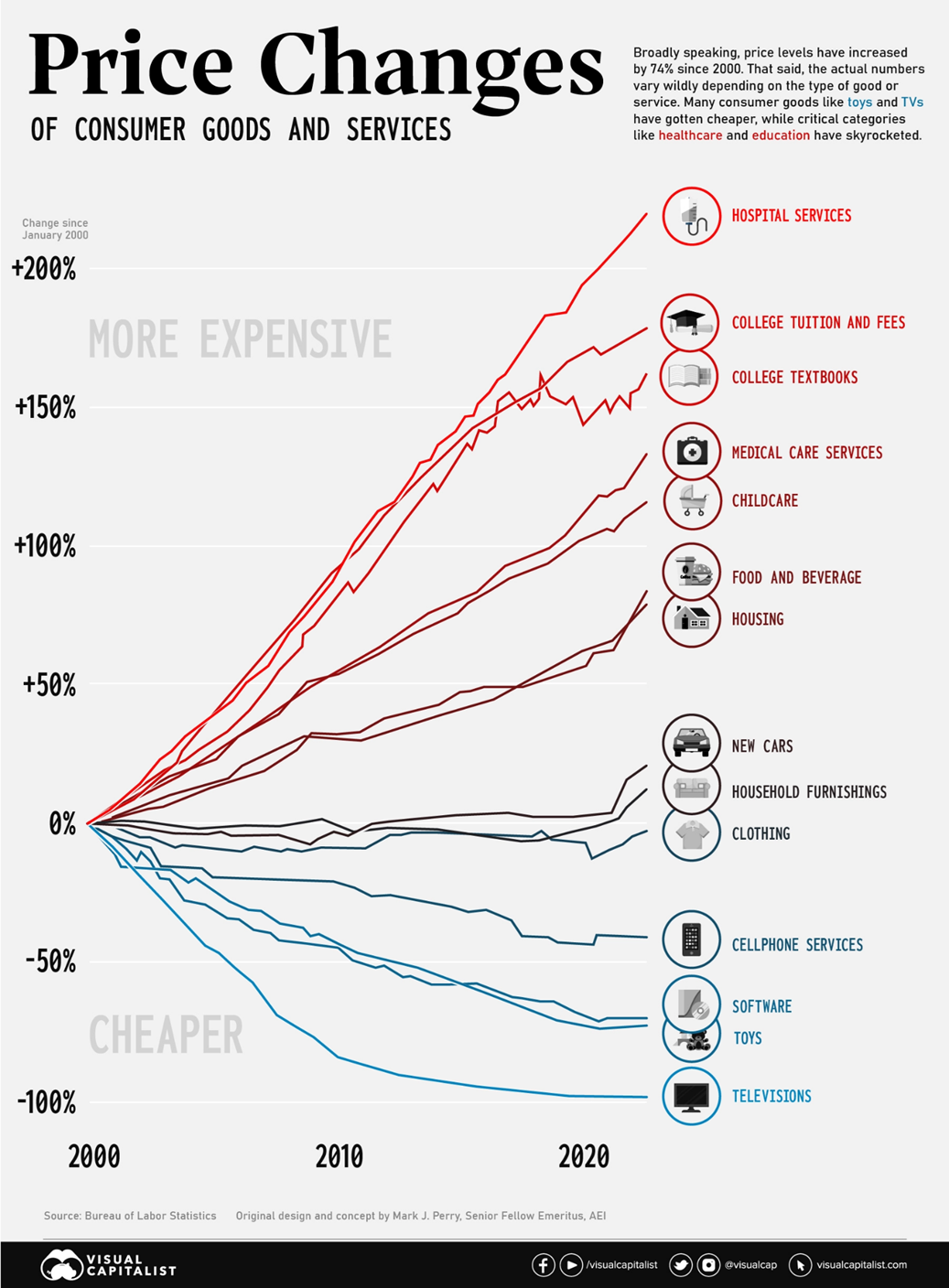

From Riverfront’s Doug Sandler, “…equity losses between 1926 and 2021 have proven temporary. On the other hand, lost purchasing power is often more permanent. Once prices rise, they rarely retreat, except in a few rare cases like electronics. Consider this, according to the AARP, just over 50 years ago (1972) coffee was $0.66 a pound, a gallon of gasoline cost $0.36, a Ford Mustang would set you back $2,510 and a postage stamp was a mere $0.08.”

Additionally, the US Treasury interest rates are telling us that this period of high CD rates won’t be around for long. A 1-year US Treasury is paying about 5.1%, while a 5-year Treasury is paying about 4.2%, which means that the fixed income market believes that rates will come down over time. So, your “limited time CD rate offer” will likely bet just that.

Avoiding the markets after a bad year is akin to my son quitting ice hockey after a relatively minor broken arm. He will recover and play hockey again, much like stocks and bonds will recover and provide positive returns over time. In both cases, doing nothing is not an option!

Looking forward to being back in action in about 6 weeks!