So Tired…

This weekend, the Yakel family had an odd weekend free. It has been forever since we have had a full weekend with no commitments, and so I built a long to-do list of all sorts of things that had been neglected in the past flurry of activity (dishes, laundry, organizing!). But, when Saturday came, we were just so tired. After months of craziness at work, coaching basketball, travelling to colleges, the holidays, homework, etc…we just crashed. The weekend was SO unproductive…we were just to tired to muster up the enthusiasm to do anything productive. So, we all slept in and watched basketball and napped…even the animals…

Right now, at Meridian, we’ve noticed investors feel the same way. Just tired. Tired of the volatility. Tired of the anxiety. Tired of the low returns. Just sheer exhaustion with investing. And, with the market being in the exact same place it was 27 months ago, it is hard to dig up a lot of enthusiasm for stocks.

Looking back over the last three years, it’s been a tough ride…

- A global pandemic hit. By the end of March, the S&P 500 had dropped nearly 20% in value.

- Later in the year, scientists announced that they’d developed a vaccine, and markets roared back.

- Big tech stocks soared … before giving up a lot of gains.

- Meme stocks shot way up … and fell back down.

- Bitcoin and other cryptocurrencies reached record highs … and then crashed.

- Inflation spiked to the highest levels most of us have ever experienced.

- Russia invaded Ukraine, sparking a humanitarian crisis and geopolitical uncertainty

And we get it—it’s hard to stomach investing after the emotional ride of the last several years. CDs and money market rates are finally above 1%, and earning 4% to 5% with a smooth path is extremely appealing…

As tempting as it is to call it a day on investing and just go buy CDs, we have had to urge our clients (and ourselves!) to beware of the lure of cash…it is a siren song right now when we are all exhausted and just looking for a safe place to earn money, but there are a few big points to remember:

- These high bank deposit rates are temporary. If you look at the CD or bond yield curve, the rates drop sharply off after 2 years. You can see it in the Capital One CD quotes above—no one is willing to issue long maturity CDs or bonds at today’s rates because there is an expectation that rates will be coming down over the next couple of years as inflation moderates.

- These interest rates on safe assets are not outpacing inflation. We are delighted to finally be able to earn interest on emergency savings and other cash being held for short-term needs, but we have to keep reminding ourselves that 4.3% on a CD when the annual inflation rate is currently 6%. We don’t see the loss, but the money in bank deposits is slowly losing against inflation, even with the higher nominal interest rates.

- Purchasing power losses are often permanent. When prices increase, they rarely retreat back to old levels. We are pretty sure Starbucks isn’t going back to coffee for a quarter…

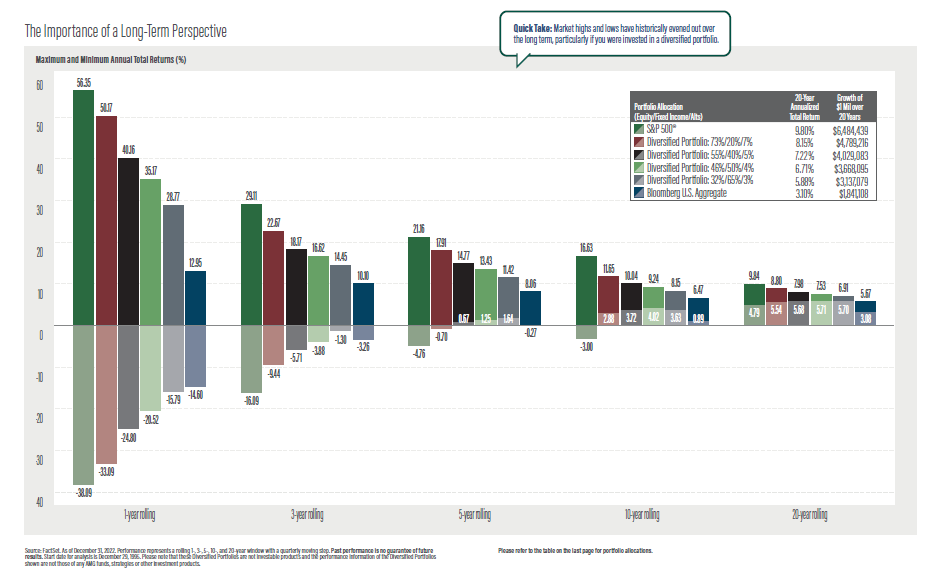

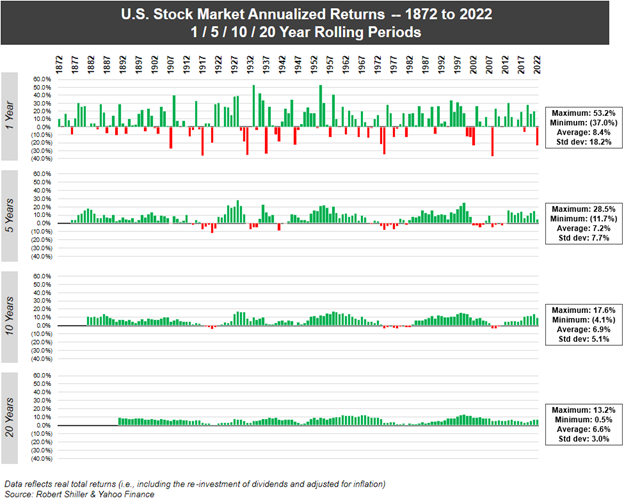

- Losses in the stock market are usually temporary. While the stock market can be very volatile over a one year period, it is a much smoother ride over a longer time horizon—and even more so when invested in a diversified manner.

And…in the entire history of the stock market, it has never been negative over a 20 year holding period.

We have to remind ourselves of these historical points often—the fatigue is real, even among professional investors. And we also remind ourselves that investor fatigue is not a new phenomenon…it happens often at the end of a really frustrating stretch in the market. Back in 2014, investors were ready to throw in the towel after the financial crisis ended…the market was extremely volatile and returns had not been as robust as in the years leading up to the housing bust. At the time, Jentner Wealth wrote:

“A recent survey found that the majority of investors say investing isn’t as fun as it was. Several years ago, more than two thirds of investors said they enjoyed investing.

Investor fatigue from recent volatile markets plus concerns about personal finances contribute to these bad feelings. People have become tired of the constant volatility. It appears that many just can’t seem to find strategies that they’re happy with.

It’s undeniable that markets have been volatile since the 2008 bear. Are investors missing the point? Is investing supposed to be fun? Some of these investors are confusing investing with speculation. It can be fun to buy a hot stock and reap a quick, large profit, just as it is fun to hit a slot machine for a big payoff.

But that is not investing. It is short-term speculation, and, just as in Las Vegas, it is just as easy to lose money as it is to win it. Certainly, many speculators have lost money in recent years as they were whipsawed by up and down markets.

Investing, on the other hand, is a long-term process of continually adding to a portfolio and giving it adequate time to grow when markets move upward. It may take several years of both small and big losses before a portfolio even shows a profit.”

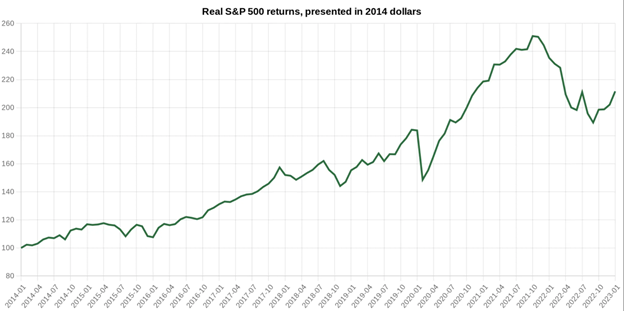

If investors had listened, and stayed invested, the S&P went on to grow 170% since then…or an annual return of 11.58%. Even after adjusting for inflation over this same time frame, the annual return was 8.68% per year.

This lump-sum investment beats inflation during this period for an inflation-adjusted return of about 112.91% cumulatively, or 8.68% per year.

Source: https://www.officialdata.org/us/stocks/s-p-500/2014#:~:text=Stock%20market%20returns%20since%202014&text=This%20is%20a%20return%20on,%2C%20or%208.74%25%20per%20year.

So, despite our own tiredness of working with a volatile and fickle stock market, we keep carrying on—making the best decisions we can with the information available, and through the eye of a long term lens. We encourage you to revisit your goals, match your portfolio to those, and then hang in there too!