Inheritance Rules Kicking In

Hoping that all our clients and readers are enjoying this glorious weather and you aren’t stuck inside finishing your taxes! Just a friendly reminder that Tuesday April 18th is the filing date and you have up until the deadline to contribute to IRAs, Roths, HSAs, and SEPs (unless you file an extension) to count towards a 2022 contribution. 😊

Whether you are recovering from paying what you owe (which in hindsight means that hopefully you made money) or you are receiving an unexpected refund (which could mean you withheld too much), now can be a good time to start doing some preliminary tax projections for 2023 and preparing yourself for what income may be taxable this year.

There is one particular source of income in 2023 that may be unexpected for beneficiaries who inherited an IRA, Roth IRA, 403(b), and 457(b). In December 2019, Congress passed the original SECURE Act, which made a lot of changes to rules around savings for retirement and retirement accounts in general. Most notably for non-spousal beneficiaries of IRAs in which the original account owner passed after Jan 1, 2020, the distribution laws changed. When published in 2019, the SECURE Act was written as below:

Pub. 590-B, Distributions from Individual Retirement Arrangements (IRAs), for 2020 and 2021 stated simply:

The 10-year rule requires the IRA beneficiaries who are not taking life expectancy payments to withdraw the entire balance of the IRA by December 31 of the year containing the 10th anniversary of the owner’s death… The beneficiary is allowed, but not required, to take distributions prior to that date.

Note the “not required”…..

Unfortunately, when the original SECURE Act was written Congress included very few details about when distributions from Inherited IRAs must be taken other than within the 10-year time frame.

Fast forward to 2022, the IRS issued proposed regulations for the original SECURE Act now requiring annual distributions from these inherited IRAs if the beneficiary is a non-spouse (with very few exceptions applying) and the original account owner (the decedent) was already at RMD age. Duh duh duh…. which means that if you inherited an IRA in the past couple of years and fit those criteria, you should have been taking RMDs in 2021 and 2022. Ah!

THANKFULLY, the IRS announced they would not apply a penalty to RMDs that should have been taken in 2021 and 2022 under the proposed regulations, but were not.

To break this down, here are the requirements:

- You inherited an IRA from a non-spouse in which they passed in Jan 1st, 2020 or later

- The original account owner was taking Required Minimum Distributions

If you answered yes to both above questions here is what you will be required to do:

- You will now be required to take annual distributions from the IRS

- Any remaining balance must be taken by the 10th anniversary of the original account owner’s death.

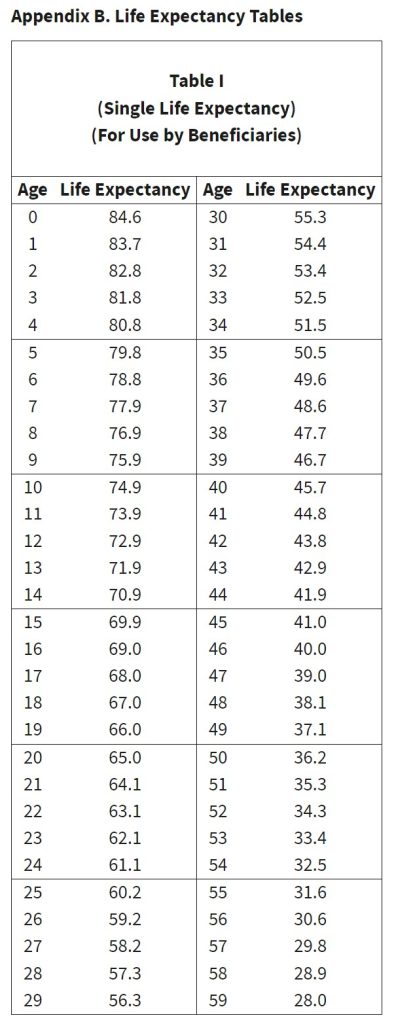

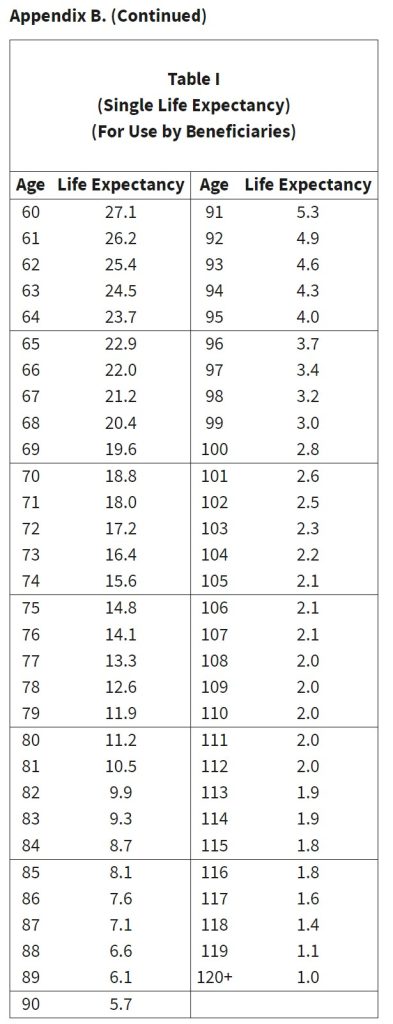

The amount you will have to take out of the IRA is determined by the IRS’s Single Life Expectancy chart.

- Side note: If you are wondering how this chart works and how RMDs are calculated, you will want to find your age in the left hand column, find the associated Life expectancy number next to your age, then whatever the value of the IRA was on December 31st of the previous year, divide that account value by your Life expectancy number. And that is how much you have to take for an RMD.

The application of this regulation has been extremely confusing and quite opaque; however, if you find yourself in the position of meeting the above criteria or inheriting an IRA please reach out to your advisor who can help you calculate this and navigate a perhaps unexpected source of income for the next few years.

Speaking of inheriting, our oldest has inherited not only her Korean heritage from my husband (he is half Korean), but also his competitive nature and athletic abilities. She has been taking Tae Kwon Do and put those inherited assets to the test!