Independence Day

The 4th of July is upon us, and it reminds me of birthdays…my husband’s birthday, my best friend’s birthday…oh and also America’s birthday. It’s a big party day for sure! 😊

Besides birthdays, the 4th of July reminds us of independence and is a celebration of freedom—both important ideals of America. We crave to be free and independent from oppression—which is why the F.I.R.E. financial movement has captured the attention of not just millennials but many Americans.

F.I.R.E. stands for “Financial Independence. Retire Early”, and the movement is gaining momentum with many stories of people retiring in their 30’s and 40’s, with some extreme F.I.R.E. zealots retiring in their late 20’s! If you Google the movement, you will find blog after blog of success stories, and there is a documentary coming out this summer.

While the goals of the F.I.R.E movement are noble, there are many issues with the assumptions and planning techniques—the main tenant of the movement is that you are able to retire once you have saved 25 times your annual living expenses. So, you either need to save dramatic sums of money (a common goal is to save 50% of your income) or live an extremely frugal lifestyle (one F.I.R.E devotee gave up his apartment to live in a box truck and showers at work)

In addition, critics point out that using the 4% withdrawal rule from your assets was designed for a secure 30 year retirement, not a potentially 60 to 70 year retirement. Also, walking away from a career in your 30’s causes you to miss out on the highest earning years of a career and caps your social security benefits. Suze Orman is a notably loud critic of the F.I.R.E. movement, as she makes clear in this podcast.

In spirit of embracing our freedom to decide how we spend and save our money, Meridian isn’t willing to follow Suze Orman in complete dismissal of the F.I.R.E movement, but rather, we’d prefer to focus on some of these basic F.I.R.E tenants that are great financial strategies (…not the living in a box truck one…):

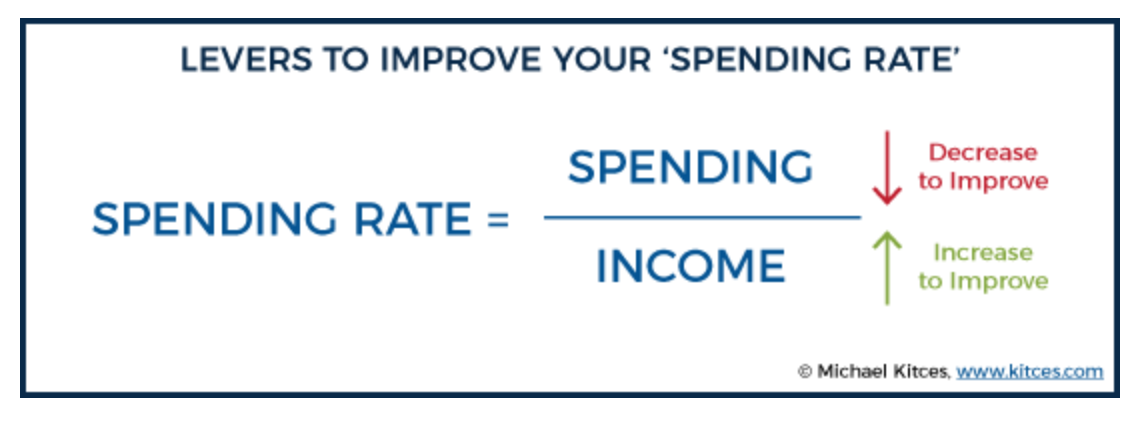

1. The way to improve your retirement success is to focus on improving what Michael Kitces calls your “spending rate”—your spending rate is what % of your income do you spend (and therefore, how much do you have left over to save). There are two ways to improve your spending rate—spend less, or make more income. Finding ways to decrease spending (cutting cable, driving old cars, buying less of a house than you can qualify for) or increasing income (pursuing promotions, side gigs, etc) both improve your spending rate.

2. If you can improve your spending rate, then there should be excess money every month to devote to savings. The F.I.R.E. movement encourages utilizing tax preferred vehicles like ROTH IRAs, your company retirement plan, or stock centered portfolios as capital gains and dividends received the low tax rate of 15%. F.I.R.E. gurus also promote being ruthless with cutting investing costs, advocating low cost index funds and ETFs as the main portfolio building blocks. We couldn’t agree more!

3. One of the driving factors behind the financial independence movement is the freedom of complete control of your time. Without the need to earn money or have a job that sucks your soul every day, you are free to pursue work, hobbies, and other projects that make you happy and actually feed your soul. However, what many F.I.R.E. advocates fail to acknowledge is that work and happiness are not necessarily mutually exclusive. While some of us may hate our jobs, some of us actually enjoy the work we do and gain enormous personal satisfaction and wellbeing from the contributions we make. One of the original F.I.R.E. superstars, Mr. Money Mustache says: “work is an incredibly powerful source of happiness. The key is that it must be creative, social and engaging work that brings you towards a purpose you believe in…early retirement, according to this new definition, does not mean quitting work, even while it may well mean quitting your job.” We love that.

Happy Independence Day!