Bonds Are Boring

Bonds Are Boring (but effective)

For most of the five years that our firm has been in existence, many of our clients asked why they own any bonds at all. It is human nature to want to invest in things that are going up all of the time, and for the most part, that’s exactly what US stocks did. “Why don’t we own more of this stuff that’s going up?” was a common refrain.

Unfortunately, the reminder of why you own bonds is when the stock market takes a sharp hit like it did in March of this year. From John Hollyer, head of global fixed income at Vanguard, “If we go back to the beginning of 2020, interest rates, particularly in government, high-quality bonds, were already pretty low. People were questioning, ‘Why do I own bonds?’ But, if we roll ahead to the end of March, a broad portfolio of high-quality bonds was up about 3% in return, while the S&P was down about 20%.”

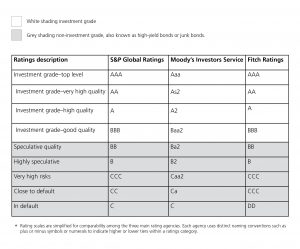

An important part of John Hollyer’s statement is “high-quality bonds.” Most bonds have a rating assigned to them based on the solvency of the issuer. In other words, can the bond issuer hold up their end of the bargain by paying the interest due and returning the principal at the bond’s maturity? There are three main ratings agencies, S&P, Moody’s and Fitch that issue their “grades” on how safe or risky a particular bond investment might be. See chart below:

It is important that bond investors look beyond just the yield (interest rate) to the actual rating of the bond (or bond fund). It is easy to fall into the trap of just buying the bond (or fund) that has the highest yield. Unfortunately, higher yields almost always mean higher risk. So, just like with stocks, bond investors should weigh their tolerance for risk along with the need for income/yield.

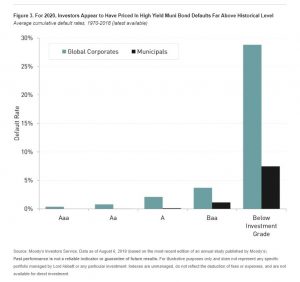

While the category of bonds is generally viewed as conservative, buying bonds that are below investment grade can bring a high level of risk. Again, the risk being that the bond issuer, corporations and governments or municipalities, will default. As you can see from the chart below, municipalities have a much lower default rate than their corporate counterparts. (credit: Lord Abbett Fixed-Income Insights)

In our current, extremely low rate environment, it is very difficult to be a conservative bond investor and find any sort of reasonable yield. For example, if you bought a 10-year US Treasury Bond right now, it would only yield you about 0.7%. That is very unlikely to satisfy many investors’ income needs. On the other end of the spectrum are high-yield (or junk) bonds, which offer attractive yields but a lot of volatility. One popular high-yield fund that we use for clients has over a 7% yield (attractive!), but a very stock-market-like return of -10% (ugh!) for the year. Sadly for all of us, there is no such thing as a high-yield bond with a high rating. As with stock investing, striking the right balance for your needs remains the key.

Speaking of needs, our children’s needs have gone up significantly with the closing of schools. I am sure many parents can relate to the difficulties of forced home-schooling. Especially if both parents are working, like most are these days. However, we have enjoyed much of our time with the kids, and we have been doing many things that normally wouldn’t have happened in the course of the regular school year.

A pleasant surprise (especially for me!) is that the whole family has gotten bit by the golf bug. We have been very fortunate to enjoy some great family outings on the course. The quality of golf hasn’t always been high, but the enjoyment factor certainly has!