The Situation with Student Loans

Summer certainly feels like it is here! Every pool with the exception of baby pools is sold out in Virginia (if you find one, let me know!), the local ice cream shop has re-opened, and high school and college graduations have come and gone. And while this year’s graduation scene looked very different from anything we have seen in the past, one thing remains the same… and that unfortunately is the amount of student loan debt both parents, graduates, and students hold.

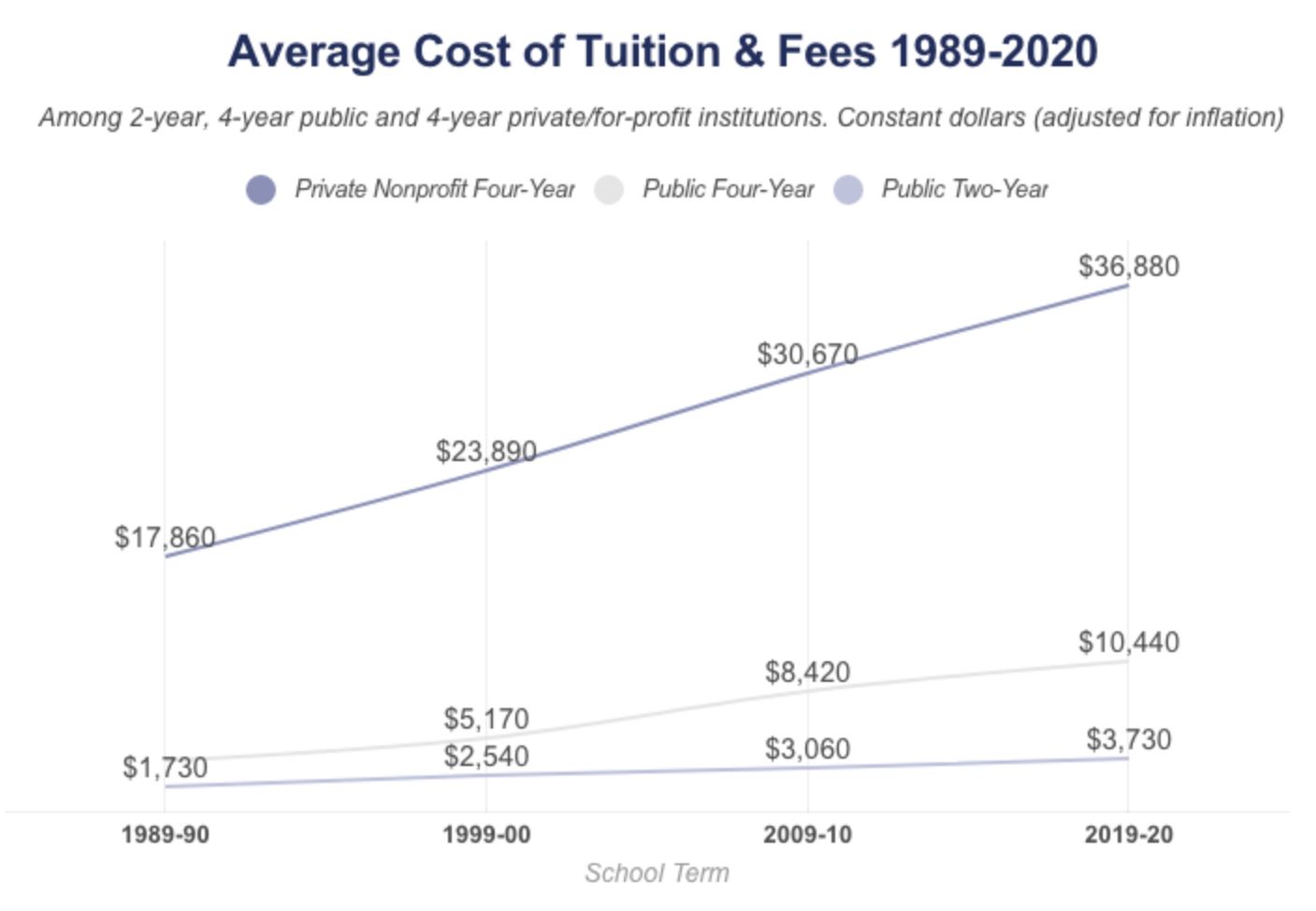

We strongly believe saving and investing now for future education costs is the preferred method to cover these costs before borrowing. Rule of thumb for parents is to save / invest about 1/3 of the costs of college. The remaining 2/3 is usually split between regular household cashflow and the student funding a portion on their own.

However, an estimated 44.7 million people have student loan debt – that’s 1 in 4 Americans. Student loans are a reality for many and while it is a vast topic, my hope is to clear up some of the mystery behind them and the available options for both parents and graduates / students.

One of the most beneficial options available right now (for certain situations) is the CARES Act Federal Student Loan relief. This package suspends most Federal student loan payments and interest accrued on those loans starting from March 13, 2020 to September 30, 2020. Borrowers who may have made a payment after March 13th can request a refund for their student loan payment. It is important to note that only Direct student loans and Federal Family Education Loans (FFELs) owned by the U.S. Education Department are eligible for relief under this section of the CARES Act. If you are a borrower participating in Federal loan forgiveness plans such as Public Service Loan Forgiveness, Teacher Loan Forgiveness, or Income Driven Repayment Plans, the payment periods suspended will be included as if payments were made, counting towards the number of payments made to determine forgiveness.

The Federal Student Aid website has a great Q&A section covering the details: https://studentaid.gov/announcements-events/coronavirus

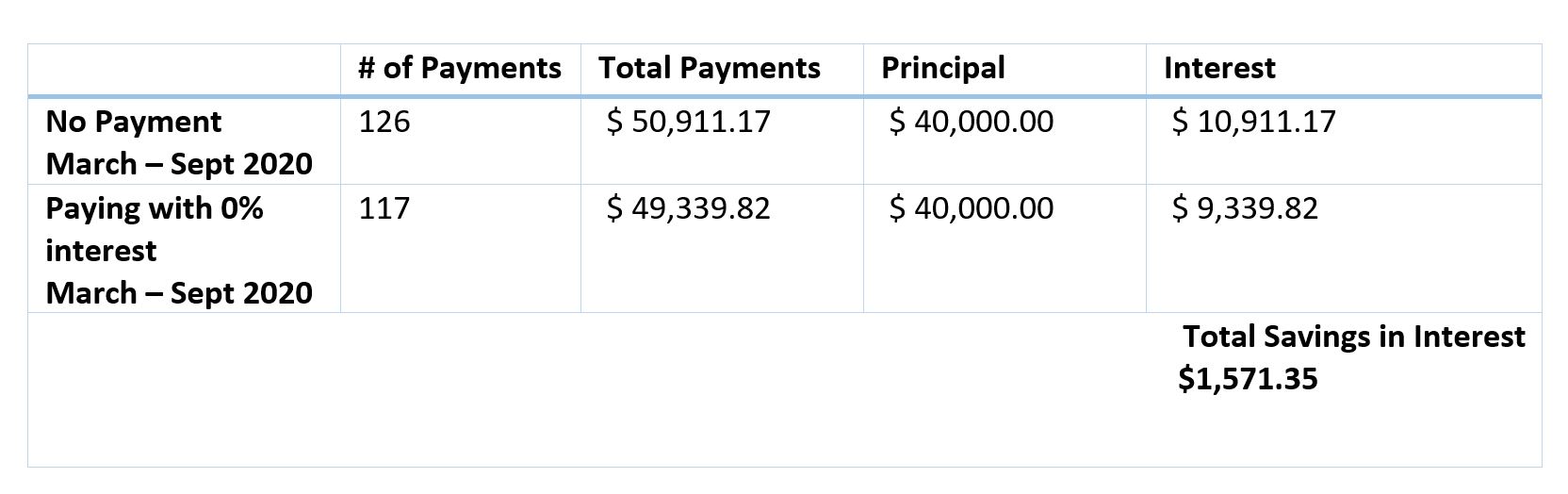

Paused loan payments for 6 months without the accrual of interest provides opportunity to either reallocate the cash to help pay off outstanding debts with higher interest rates, contribute to your investments, or build up emergency savings. While pausing payments until October may be appealing for many, if income is steady and there are sufficient cash reserves, any payments now until October take advantage of the 0% interest rate and are applied to the principal of the loan; therefore paying it down faster.

The below chart shows a simplified example of the differences between continuing to pay during the 6 months forbearance vs pausing payments on a $40,000 10 year loan with a fixed 5% interest rate. Not only are you saving in interest but you are cutting down the time you are paying down the loan by 9 months. This is a great strategy for those who have the cash flow now.

While borrowers who have private student loan debt do not directly benefit from the CARES Act, many lenders are providing their own options for relief, so it is important to contact them directly.

Although the landscape could very well change for student loans in the future, below is a cheat sheet on types of repayment and forgiveness options available outside of the provisions put in place by the CARES Act.

- Federal Student Loans

- Consolidating – *Must be done borrowing in order to consolidate

- This will make payments easier as you will be paying towards one loan, not multiple. It will also qualify you for student loan forgiveness programs. **Consolidating may give you the opportunity to lower your monthly payment HOWEVER this will extend the term of the loan.

- Federal Loan Forgiveness Programs

- Public Service Loan Forgiveness (PSLF)

- Must be a full-time employee at a federal, state, local government agency. All Direct Loans are applicable. After 10 years of consistent payments, remaining loan forgiveness can be forgiven

- This applies to Parent PLUS loans

- Income-Based Repayment (IBR) Program – this should only be explored if the 10-year Standard Repayment plan is not doable

- Sets payments at 10-15% of your discretionary income. After making consistent payments under IBR for 20 to 25 year, any remaining loan balance will be forgiven.

- Should be noted that the forgiven balance is treated as taxable income.

- Pay As you Earn (PAYE)

- PAYE payments must be less than what they would be under the 10-year Standard Repayment Plan.

- Caps your monthly payment at 10% of discretionary income. After 20 years of payments, any remaining balance becomes eligible for forgiveness. Must make consistent payments for the 20 years.

- Forgiveness with Income-Contingent Repayment (ICR)

- Adjusts monthly payments according to your income. Either you pay 20% of your discretionary income or what you would pay on a fixed 12-year plan, whichever is less.

- This is the only income driven plan available to the Parent PLUS Loans ; however loans must be consolidated first.

- After 25 years of on-time payments, the rest of the balance will be forgiven.

- Federal Perkins Loan cancellation

- Must be in a qualifying profession and in most cases work in the profession for at least one year.

- Forgives a certain percentage of student loan debt after every year of service.

- Student Loan forgiveness for teachers

- Must work in a qualifying school for at least 5 consecutive years. The only eligible loans are Subsidized and Unsubsidized Direct Loans, and Subsidized and Unsubsidized Federal Stafford Loans.

- Public Service Loan Forgiveness (PSLF)

- Consolidating – *Must be done borrowing in order to consolidate

- Private Student Loans

- Consolidating / Refinancing– Must have graduated and be done borrowing in order to consolidate / refinance.

- This will make payments easier as you will be paying towards one loan, not multiple and it will give you the opportunity to lower the interest rates on the private student loans.

- You can consolidate / refinance both private and Federal student loans together; however you lose the ability to qualify for Federal repayment programs.

- Must have made a few on-time student loan payments after leaving school.

- Have good or excellent credit (credit score of 690 or higher)

- Must be employed

- If none of the above apply, must have access to a co-signer with the above characteristics.

- Consolidating / Refinancing– Must have graduated and be done borrowing in order to consolidate / refinance.

As the above summary outlines, Federal student loans qualify for many more forgiveness and repayment programs; however, those who do not qualify for any of those programs and have a combination of steady income and good credit may benefit from a possible lower interest rate through a private student loan. We would recommend contacting your advisor regarding what options are best for you and your personal situation.

While student loan debt can certainly feel overwhelming, we believe having a basic knowledge on the types of loans available, understanding the near term and long term repayment options, and following a pragmatic strategy to paying off the loans should create a clearer path to living student loan debt free!

I personally know that planning for higher education are currently and will continue to remain a priority in our life as our two little ones grow. Until then we are just focusing on teaching our three year old to write her name…. not bad if I do say so myself!