Rates are Increasing… What to Do?

In writing the blog for this week I debated whether I should write about something completely opposite from the overload of information we have had on the current economic and geopolitical landscape or if I should meet a very relevant topic head on. Needless to say, Jerome Powell’s “hawkish” commentary yesterday made the decision for me.

“[M]y main message today is that, as the outlook evolves, we will adjust policy as needed in order to ensure a return to price stability with a strong job market,”

“I hasten to add that no one expects that bringing about a soft landing will be straightforward in the current context—very little is straightforward in the current context. And monetary policy is often said to be a blunt instrument, not capable of surgical precision. My colleagues and I will do our very best to succeed in this challenging task. It is worth noting that today the economy is very strong and is well positioned to handle tighter monetary policy.”

“In particular, if we conclude that it is appropriate to move more aggressively by raising the federal funds rate by more than 25 basis points at a meeting or meetings, we will do so. And if we determine that we need to tighten beyond common measures of neutral and into a more restrictive stance, we will do that as well.”- Jerome Powell

Rising interest rates is not a new topic (see some of our blogs here, here, and here ), but it is a topic which continues to remain relevant for investors particularly since the Federal Funds Rate increase last week for the first time since December 2018 and there is the expectation that there will be seven rate hikes this year and four next year. This has obviously caused some commotion and made headlines as commentators worry about the ability for rate hikes to tame inflation as well as the implications of too much hiking too fast.

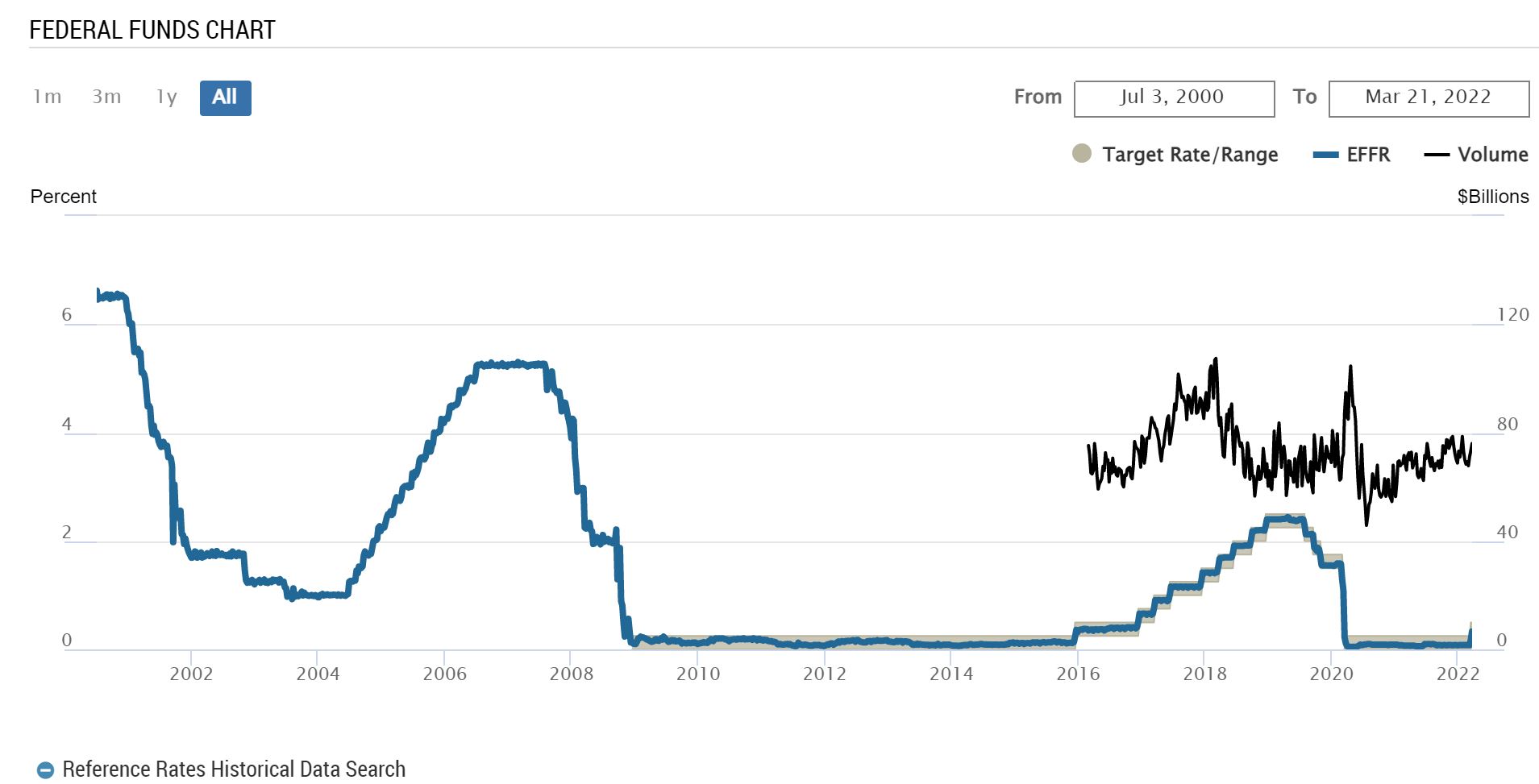

With all of that said, I think it is important to note the below chart to provide some perspective on where we are today in terms of rates:

Rates are still extremely low.

So how does this rising rate environment effect investors? Particularly since years of extremely low rates have supported the market conditions over the last few years (i.e – growth’s outperformance of value and the piling of money into speculative investments).

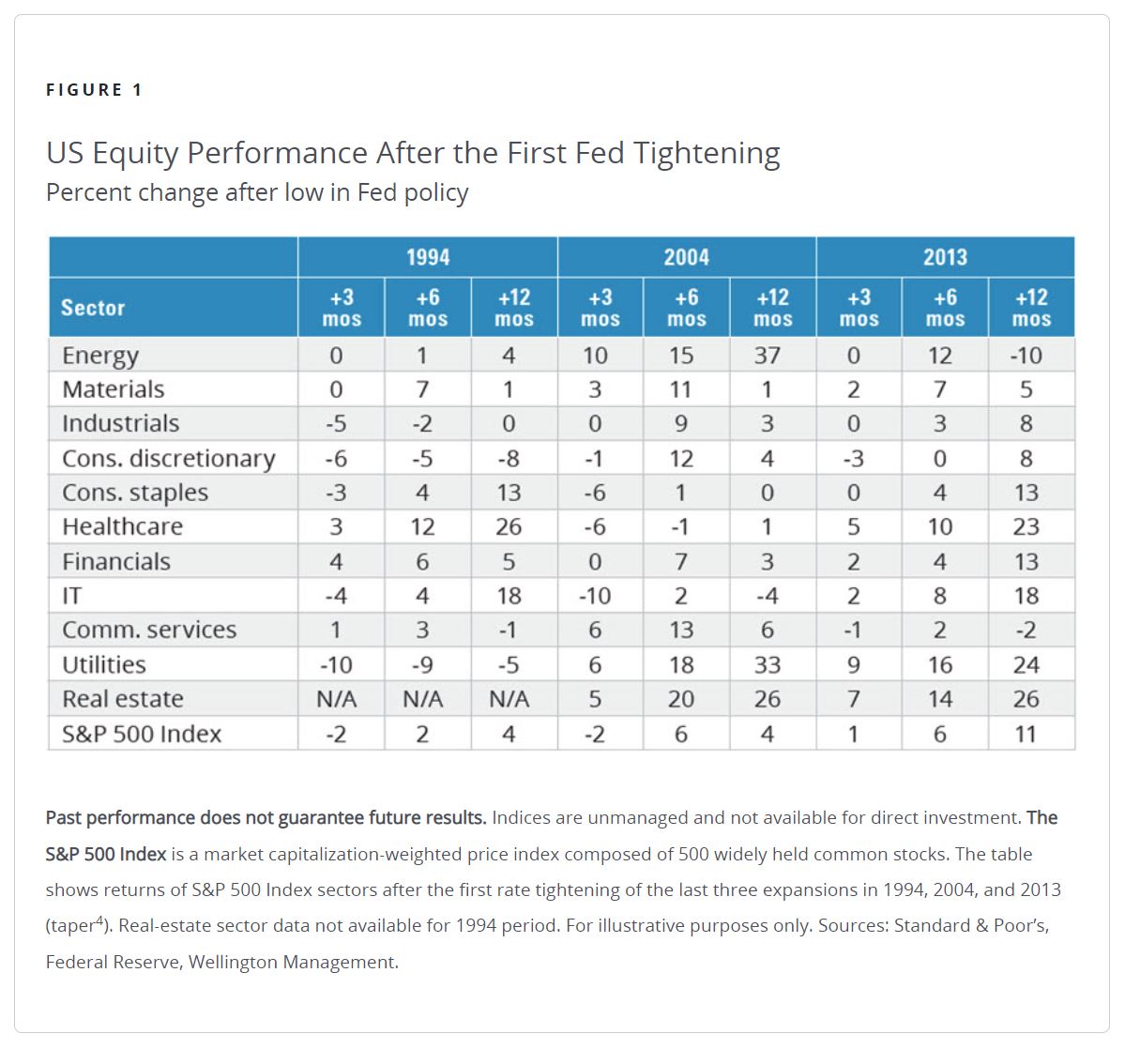

Over the last three periods of rising interest rates, stock sector performance rotates depending on the length of time from the first Fed tightening.

- Energy, financials, and materials held up immediately after the first tightening

- Healthcare, consumer staples, and IT performed well in two of the three periods

- Real Estate and Utilities performed extremely well in two of the three periods

Note that a well diversified portfolio owns some of each of these, making the recovery smoother.

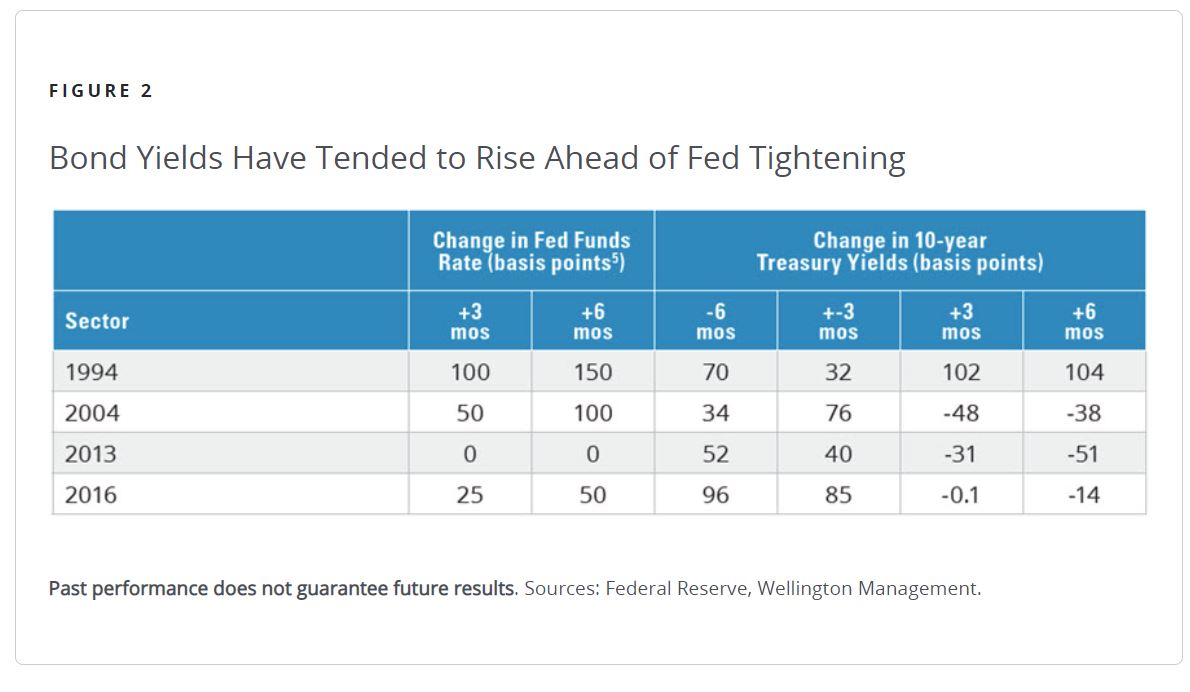

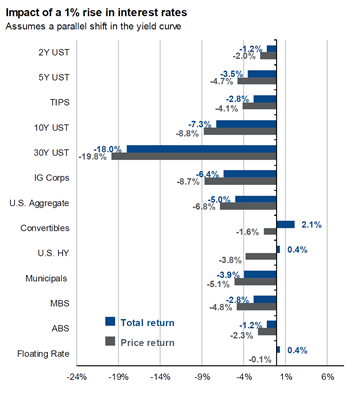

On the bond side, yields tend to rise ahead of the first rate hike (which means bond price moves in the opposite direction i.e down). However, yields then tend to decrease the 3 and 6 months after the first rate hike (bond prices go up).

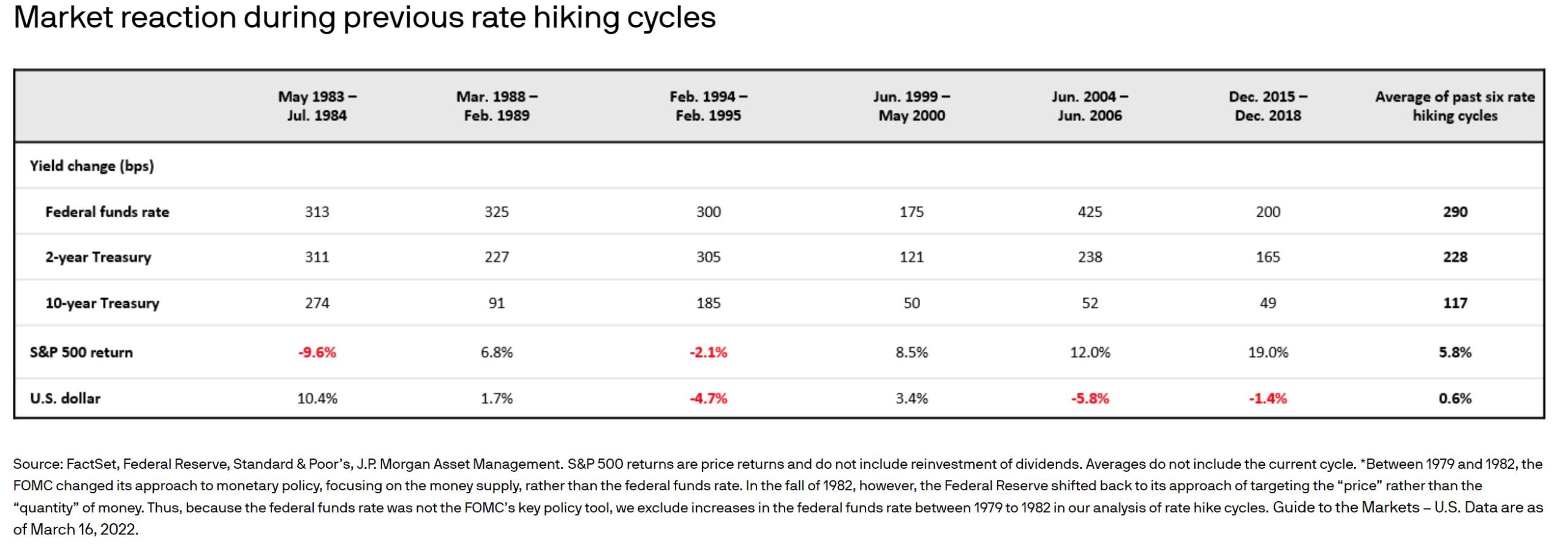

Zooming out even further at the last six rate hiking cycles, short term rates rose faster than long term rates and market performance averaged out to be in positive territory for stocks.

And while increases in interest rates lower bond prices in the short term, increasing interest rates only mean that the outlook for bonds is actually better than before yields went up — higher yields means greater interest income is on the way. Active portfolio management and maintaining diversification in a bond portfolio reduces this price volatility by providing exposure to areas that tend to hold up in a rising rate environment.

While bonds historically correlate negatively with stocks and this allocation provides diverisification and dampens volatility in the stock market (perfect example has been this year so far), correlation does increase slightly as interest rates increase. However, the slight increase in correlation (i.e – the degree to which two securities move in relation to one another) is minimal and a high quality bond portfolio continues to provide diversification away from stocks. Also worth noting that in the below chart the annualized total return for the last six periods of rising interest rates of a diversified portfolio have been positive over 80% of the time.

It is true that the current US and global environment makes it difficult to draw exact parallels between the previous historical rate hikes and today, but we do think there is some weight to the saying, “History doesn’t repeat itself, but it often rhymes”. In summary, the best protection against rising interest rates for investors is prudent rebalancing and maintaining a diversified portfolio within stocks, bonds, as well as maintaining an appropriate asset allocation in line with your risk tolerance.