The Value of Planning

Market news has continued to be painful to watch, with bonds, stocks, and now commodities falling this year. The Meridian team has written about opportunities that we see in previous blogs (like this one or this one), and we continue to talk to our clients about the unfolding economic uncertainty and reasonable actions to take in these difficult times.

In our role as advisor to our clients, we take seriously our responsibility to help guide thoughtful decision making and wise action. Today more than ever, we want to focus on what we can control and not let ourselves be distracted by things we can’t. We’ve mentioned many of these previously, but here are several of the more common actions we are recommending:

- Keep a long-term perspective. One of the important benefits of working with us as your advisor is that we can help you manage your financial situation in a holistic way, which will enable you to stay true to your long-term investment strategy guidelines and discipline. This is true both for your existing investments as well as any new investments you plan to make over time. In that process we can help you resist the urge to sell out of equities during a downturn, only to then have to try to decide when to eventually get back in. Our goal is to help you stay invested, at a reasonable allocation level, which is the only way to ensure participating in the recovery in prices that history shows is critical to achieving long-term success. What’s more, we can prudently and incrementally add to stocks when their prices become more attractive, and their future expected returns are better. With this strategy we can potentially take advantage of a volatile market environment and by adding to investments at prices likely to generate far better long-term returns that what was possible before this period began. This is one of the best ways for us to support you reaching your financial goals in the years to come.

- Confirm an appropriate “emergency fund”. One of the best strategies to help you sleep at night, even during market volatility, is to ensure the funds you need for spending in the near future are not at the mercy of short-term market movements. We work with clients to make sure they have an appropriate amount of cash or low-volatility investments set aside to fund either spending needs or just as an emergency fund—keeping this money steady when the near future is unknown.

- Revisit financial planning and/or cash flow projections. By reviewing how your resources will support cash flow needs into the future, we can help ensure that your spending should be sustainable. And if making changes to expenses in the near term would be advantageous, that could be a positive step to take during a difficult time. Reviewing scenarios for how the future may play out can be very helpful in creating the appropriate context for making decisions today.

- Use market declines as an opportunity to harvest tax losses. A downturn in prices isn’t what we hope for when investing. But one way to make lemonade out of those lemons is to sell securities that are down from their purchase price. By “harvesting” those realized losses they can be used to offset taxable realized gains. This tax-saving strategy can be helpful today and possibly for many years into the future, since realized capital losses can be carried forward on your tax return. As we harvest losses, the proceeds from those sales are used to purchase investments in a similar category, so your portfolio allocation and opportunity to catch an upswing stay intact.

- Consider a Roth IRA conversion. Roth conversions offer the opportunity to transition investments from a traditional tax-deferred IRA account to a Roth IRA, where they will benefit from tax-free growth going forward. The conversion will be taxable, but a market downturn could be a good time to make this transition with assets that have fallen in price, as their subsequent growth when the market recovers will be in the tax-free Roth IRA.

- Take breaks from the 24/7 news cycle. We encourage you to take time away from the news and daily updates. The constant news feed is focused on getting attention and benefits advertisers, not investors. It can be overwhelming to the viewer, and that can lead to unnecessary stress and anxiety. It’s important to stay both physically and mentally healthy so you can make the best decisions for your overall benefit.

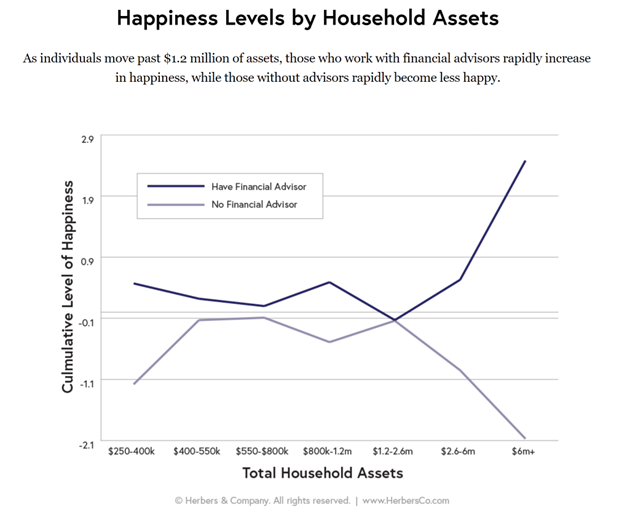

We hope to add great value to our clients by helping each one make wise decisions in the face of great uncertainty. Many studies have been done that try to quantify the actual value of an advisor (Vanguard figured advisors add about 3% of value annually), but one interesting one that was recently published is that people with financial advisors are significantly happier (across all wealth levels) than those without an advisor.

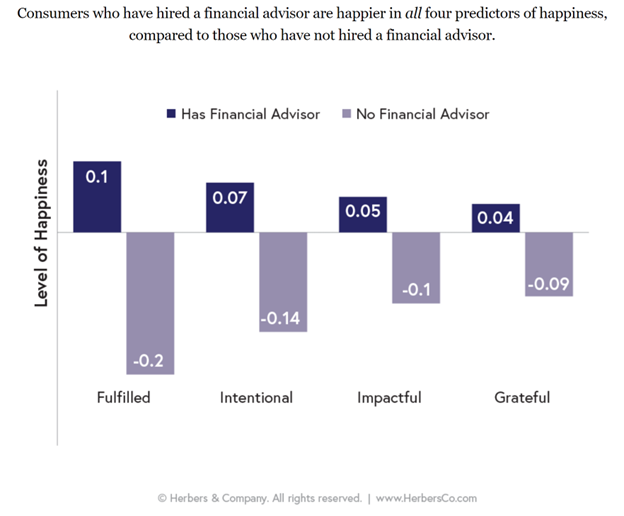

In this recent study by Dr. Sonya Lutter, people with a financial advisor report feeling greater fulfillment, intentional living, impact, and gratefulness.

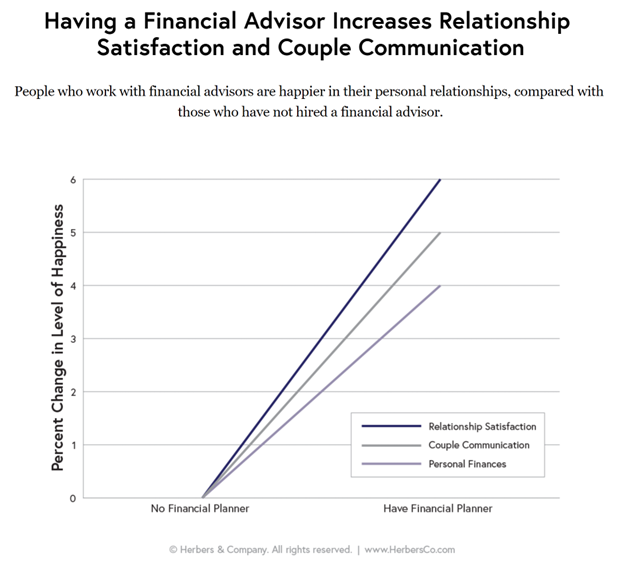

People with a financial advisor also indicated greater relationship satisfaction:

And, at certain levels of wealth, having a financial advisor makes a stark difference in overall happiness:

While we cannot directly impact the market environment, we do work to make a positive impact for each of our clients—making a difficult and uncertain time less frightening.